The global IT spending landscape presents both tremendous opportunities and significant challenges for startups seeking to establish themselves in enterprise markets. While the total addressable market appears massive at first glance, the reality for emerging companies is far more nuanced, shaped by regional purchasing behaviors, cultural preferences, and established vendor relationships that can either accelerate or hinder startup growth.

The Global IT Spending Landscape: Size and Scale

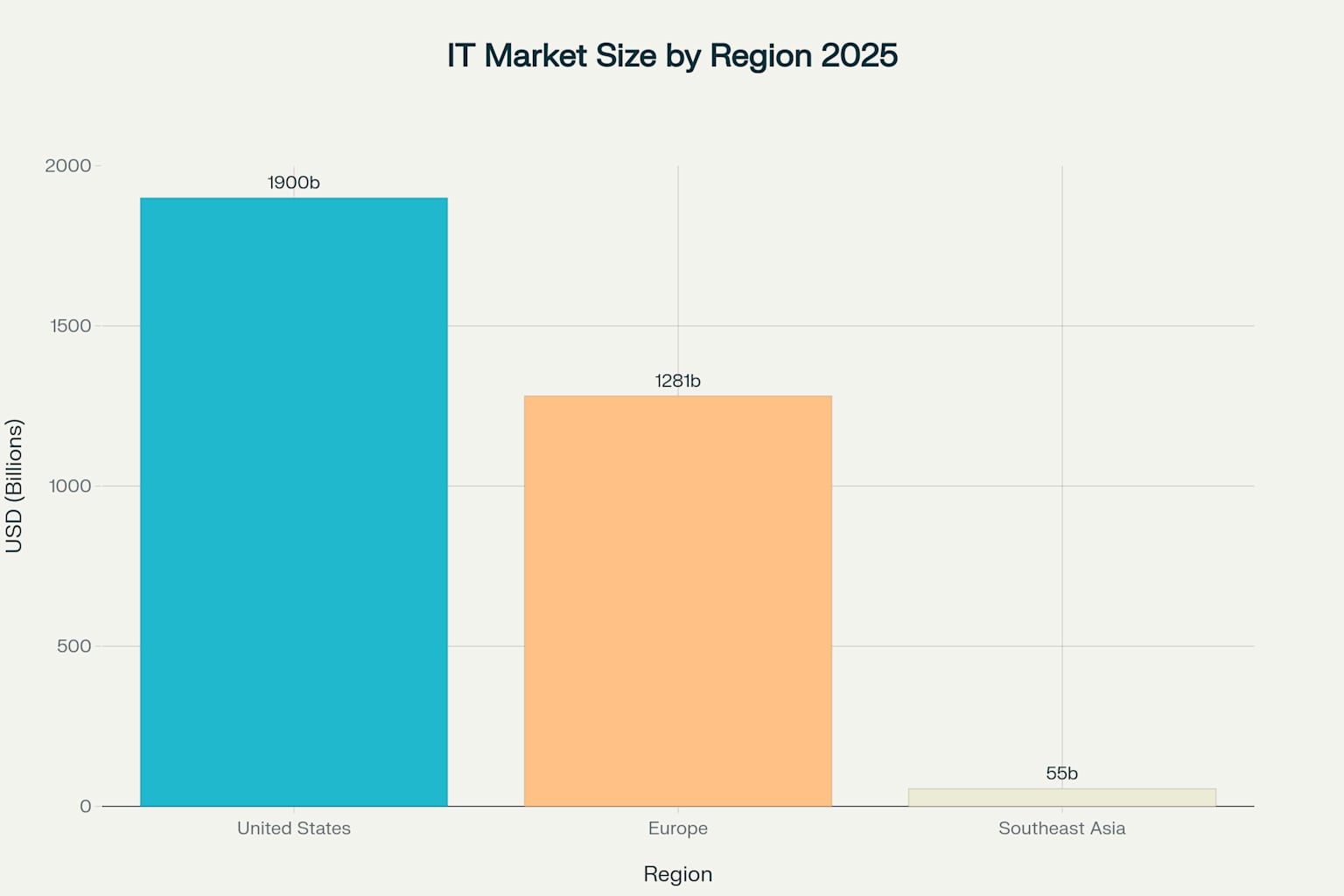

The worldwide IT market represents one of the largest and fastest-growing sectors in the global economy. In 2025, global IT spending is projected to reach $5.61 trillion, with significant regional variations that directly impact startup opportunities1. The three major regions present distinctly different market characteristics and growth trajectories.

The United States dominates the global IT spending landscape with a forecasted $1.9 trillion market in 2025, representing nearly 35% of worldwide IT expenditure. This massive scale reflects both the maturity of American enterprise technology adoption and the substantial budgets allocated to digital transformation initiatives. European IT spending, while substantial at $1.28 trillion in 2025, demonstrates more conservative growth patterns with established enterprises showing measured adoption of new technologies. Southeast Asia, though representing the smallest absolute market at $55.1 billion, exhibits the highest growth potential with a compound annual growth rate of 9.1%.

Regional Market Dynamics and Characteristics

United States: Innovation-Friendly but Highly Competitive

The American market offers the most favorable environment for startup penetration, characterised by high enterprise spending per employee ($916 annually) and a cultural openness to innovative solutions. US enterprises demonstrate greater willingness to engage with unproven vendors when the technology offers compelling advantages. However, this market also presents intense competition, with over 50,000 active startups competing for attention.

American enterprises allocate substantial budgets to software, with enterprise software spending projected to reach $159.39 billion in 2025. The venture capital ecosystem provides robust support, with $209 billion invested in 2024, creating a funding-rich environment that enables startups to compete effectively.

Europe: Conservative Procurement with Established Vendor Bias

European enterprises exhibit more conservative purchasing behaviours, with a strong preference for established vendors and proven solutions. The enterprise software market of $70.6 billion in 2025, while substantial, requires startups to navigate complex procurement processes that often favor incumbent suppliers. European buyers demonstrate lower per-employee spending ($168) compared to their American counterparts, reflecting more cautious technology investment approaches.

The challenge for startups in Europe extends beyond market size to cultural procurement preferences. European organizations typically require extensive validation and proof of concept before considering new vendors, particularly those without established track records. This creates significant barriers to entry for emerging companies seeking to establish market presence.

Southeast Asia: Emerging Opportunities with Growing Digital Adoption

Southeast Asia presents a unique opportunity for startups, despite its smaller absolute market size. The region's enterprise software market of $4 billion in 2025 reflects emerging digital transformation initiatives and increasing acceptance of innovative solutions. With only $11 per employee spent on enterprise software, the market demonstrates significant upside potential as digital adoption accelerates.

Regional characteristics favor startup penetration, with 69.3 billion in technology investments from global majors demonstrating growing confidence in the market. The startup ecosystem, while smaller with approximately 4,000 companies, faces less saturated competition compared to mature markets.

Startup Total Addressable Market Analysis

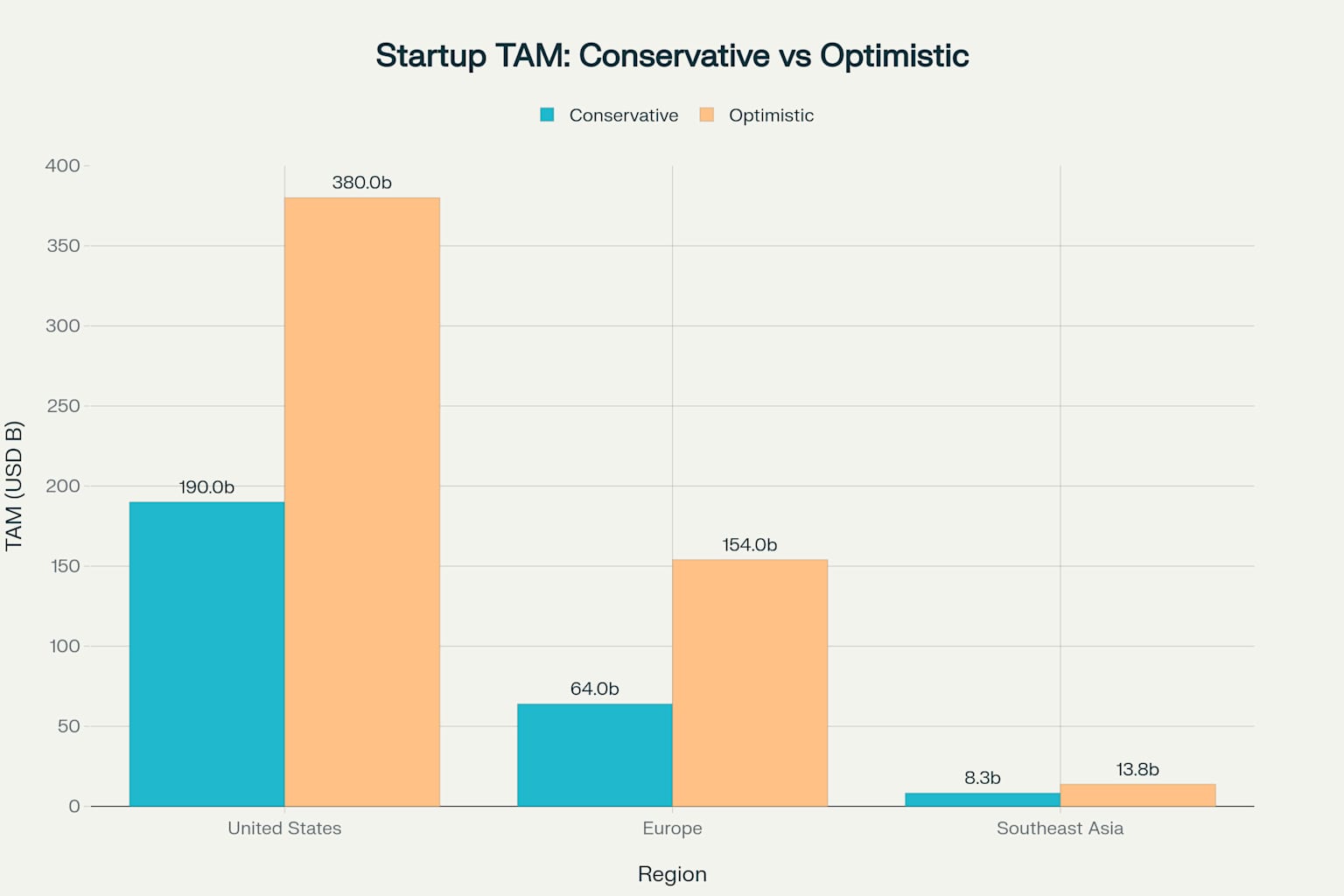

Understanding the realistic market opportunity requires moving beyond total IT spending figures to analyse what portion of these markets is genuinely accessible to startups. Traditional market analysis often overestimates startup opportunities by failing to account for established vendor relationships, procurement biases, and enterprise risk aversion.

Conservative estimates suggest startups can realistically target 10% of the US IT market, 5% of the European market, and 15% of the Southeast Asian market.

These percentages reflect the varying degrees of market openness to new vendors and cultural acceptance of startup solutions. Under conservative scenarios, this translates to addressable markets of $190 billion (US), $64 billion (Europe), and $8.3 billion (Southeast Asia).

Optimistic projections, assuming successful market penetration and cultural shifts toward startup adoption, increase these figures to $380 billion (US), $154 billion (Europe), and $13.8 billion (Southeast Asia). These optimistic scenarios require startups to overcome significant cultural and procedural barriers that currently limit market access.

Cultural and Procurement Challenges

Enterprise Risk Aversion and Vendor Selection

Modern B2B purchasing decisions involve complex stakeholder groups, with 77% of buyers rating their procurement experience as extremely challenging. This complexity particularly disadvantages startups, as procurement teams often exhibit unconscious bias toward familiar suppliers and established vendors.

The incumbent supplier bias represents a significant barrier for startups across all regions. Procurement professionals frequently favor existing relationships due to loss aversion and risk management concerns. This bias becomes particularly pronounced in Europe, where conservative procurement practices and established vendor preferences create higher barriers to entry.

Regional Purchasing Behaviour Variations

American enterprises demonstrate greater willingness to engage with innovative startups, particularly when solutions offer clear competitive advantages. The cultural acceptance of risk-taking and innovation creates more opportunities for unproven vendors to gain initial customer traction.

European procurement practices emphasise stability and proven performance over innovation potential. The preference for established vendors creates longer sales cycles and higher customer acquisition costs for startups. Additionally, European enterprises often require extensive compliance documentation and regulatory adherence that can overwhelm resource-constrained startups.

Southeast Asian markets show increasing openness to startup solutions, driven by rapid digital transformation initiatives and less entrenched vendor relationships. However, limited local funding and smaller average deal sizes can constrain growth potential for startups in this region.

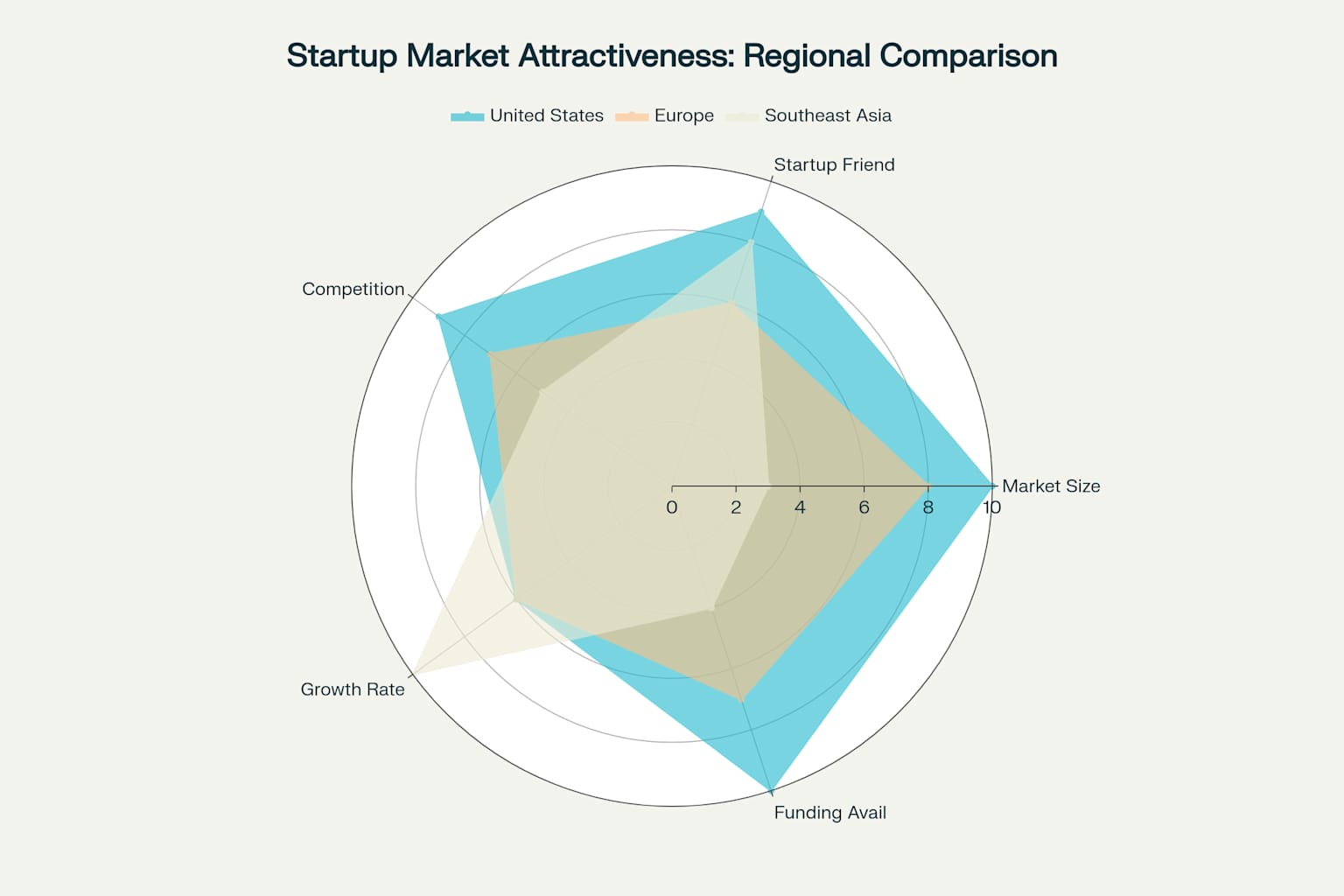

Market Attractiveness Assessment for Startups

A comprehensive evaluation of startup market attractiveness reveals significant variations across regions when considering multiple factors beyond simple market size. The United States scores highest overall (8.8/10) due to exceptional market size, startup-friendly culture, and abundant funding availability.

However, intense competition and high customer acquisition costs present ongoing challenges.

Europe's moderate attractiveness score (6.8/10) reflects substantial market size offset by conservative procurement practices and limited startup friendliness. The region's established vendor preferences and complex regulatory environment create additional barriers for emerging companies.

Southeast Asia's balanced score (6.0/10) demonstrates the region's potential despite smaller absolute market size. High growth rates and emerging digital adoption create opportunities, though limited funding availability and smaller enterprise budgets constrain immediate potential.

Strategic Implications for Startups

Market Entry Strategy Considerations

Startups should approach these regional markets with differentiated strategies reflecting local characteristics and constraints. In the United States, focus on rapid scaling and competitive differentiation to capture market share before competitors respond. The abundant venture capital and cultural acceptance of innovation support aggressive growth strategies.

European market entry requires patience and methodical relationship building. Startups should invest in compliance capabilities, case study development, and partnership strategies with established system integrators. The longer sales cycles necessitate sufficient funding runway and realistic growth expectations.

Southeast Asian markets offer opportunities for startups willing to adapt solutions for emerging market requirements. Lower price points and simplified implementations can create competitive advantages, though startups must balance reduced margins against growth potential.

Funding and Growth Considerations

The dramatic differences in venture capital availability across regions significantly impact startup viability. With $209 billion in US venture funding compared to $18 billion in Europe and $1.6 billion in Southeast Asia, American startups enjoy substantial funding advantages.

This disparity affects everything from product development timelines to customer acquisition strategies.

European startups face funding constraints that require more capital-efficient growth strategies and earlier focus on profitability. The limited venture capital ecosystem demands stronger unit economics and more conservative growth projections.

Southeast Asian startups must often rely on international funding sources or bootstrap growth through early revenue generation. The emerging venture capital ecosystem provides opportunities but cannot match the scale available in more mature markets.

Conclusion: Realistic Market Opportunities for Startups

The global IT spending market, while massive in aggregate, presents highly varied opportunities for startups depending on regional characteristics and cultural factors. The United States offers the largest addressable market and most startup-friendly environment, but also the most intense competition. Europe provides substantial market opportunity tempered by conservative procurement practices and established vendor preferences. Southeast Asia presents emerging opportunities with high growth potential but smaller absolute market size and limited funding availability.

Successful startup market entry requires understanding these regional nuances and developing strategies aligned with local purchasing behaviors and market dynamics. Rather than viewing the global IT market as uniformly accessible, startups must carefully evaluate regional characteristics, cultural preferences, and competitive landscapes to identify realistic growth opportunities and develop appropriate go-to-market strategies.

The real market size for startups is significantly smaller than total IT spending figures suggest, but substantial opportunities exist for companies that understand regional dynamics and adapt their approaches accordingly. Success requires matching startup capabilities with regional market characteristics, building appropriate funding strategies, and developing solutions that address specific regional requirements and preferences.